Why zKYC is the future of compliance

If blockchain infrastructure is so much better than traditional finance, why isn’t all $120 trillion of global financial assets onchain yet?

At the Privacy & Compliance Summit during DevConnect 2025, Lancelot presented why zero-knowledge KYC is the infrastructure layer that will bring traditional finance onchain.

You can watch the video or read the annotated transcript below.

Today, we're taking a step back to answer a fundamental question: if blockchain infrastructure is so much better than traditional finance, why isn't all $120 trillion of global financial assets onchain yet?

The answer isn't technical, it’s regulatory. Let’s dive in.

Why real-world assets are moving onchain

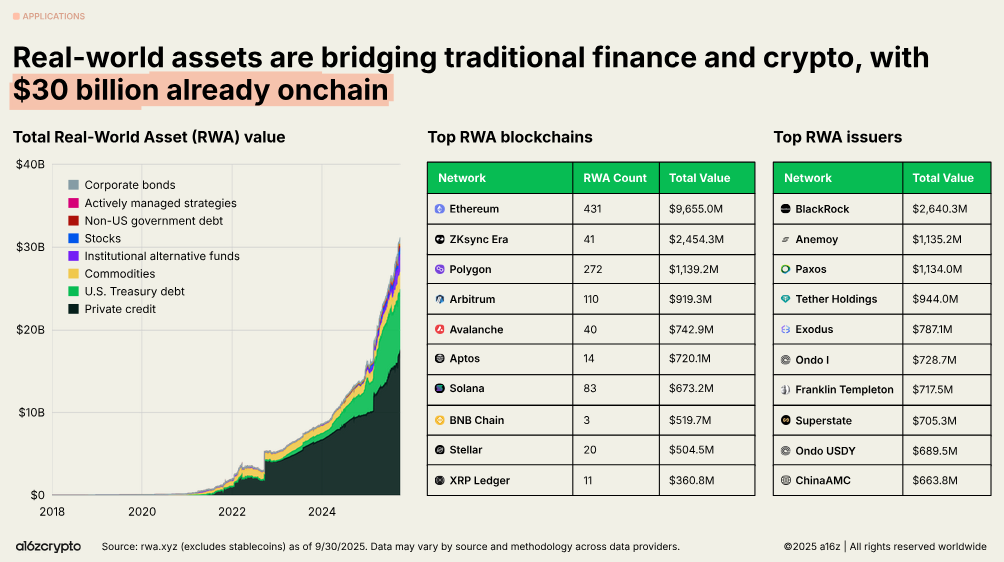

Total real-world asset value onchain is growing exponentially.

That’s because traditional finance infrastructure is genuinely terrible.

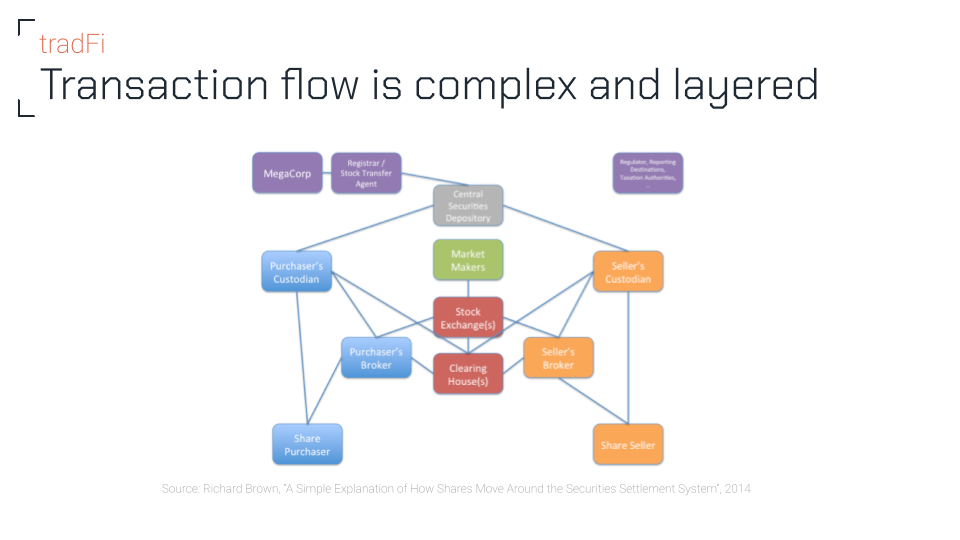

Banks are still running on systems from 1977. SWIFT launched the year Star Wars came out! Major French banks famously run on COBOL. Traditional finance is actually decentralized in the worst possible way: everyone has their own ledger, their own reconciliation process, and bridges everywhere that take days to settle.

If you sell an equity stock today, it legally takes 48 hours before the buyer owns it. Years ago, Ethereum was already doing better than this.

This (simplified!) chart shows what happens when you sell a stock. It's not great:

Blockchain fixes the settlement issue, but creates new problems

Stablecoins show what's possible.

Compared to traditional rails, blockchain-based transfers have:

- Much lower cost

- Near-instant settlement

- Transparency and auditability

- Easy cross-border support by default

Blockchain excels at consensus, transactions, and auditability. We're genuinely good at the things traditional finance struggles with most!

But we have three critical gaps:

- Performance. Both Visa and Mastercard process around 15,000 transactions per second. That's not astronomical, but it's still significantly higher than most chains can handle today.

- Privacy. Most blockchains have none: everything is public by default.

- Compliance. When privacy does exist (like with Zcash), there's no way to ensure regulatory compliance. Regulators don't love Zcash, no matter how much we do.

Two futures for onchain finance

Some new chains claim to solve all three problems at once. They say they're high-performance, private, and compliant.

And they are. But only because they're centralized corporate chains. And I wouldn't count on the SEC not knowing what happens on those chains.

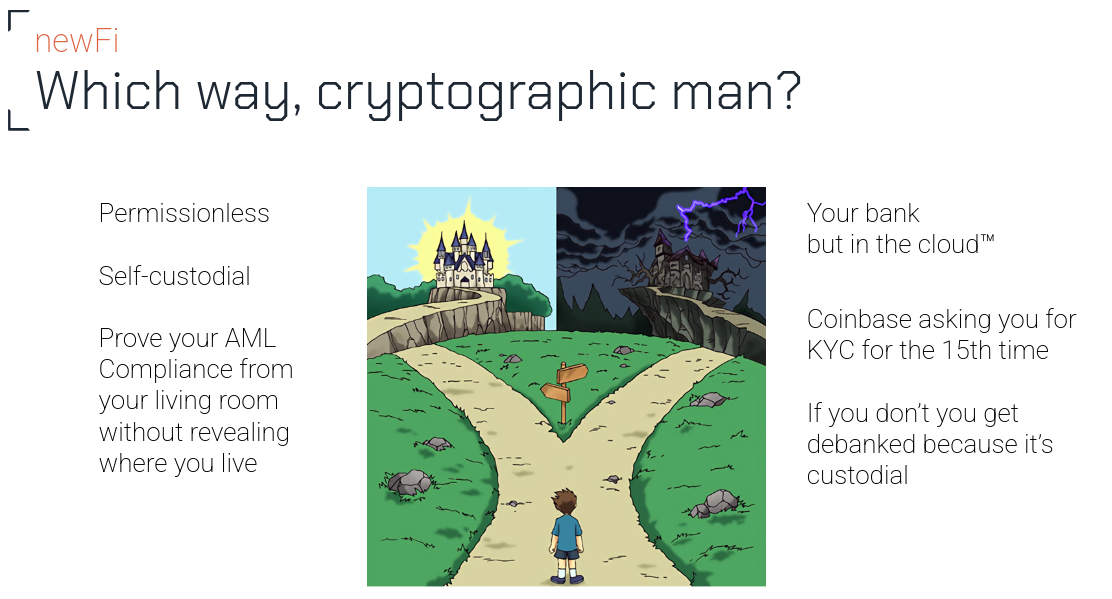

So we face a choice between two futures:

- The surveillance state: Your bank, but in the cloud. Still asking for KYC for the fifteenth time this week. Still able to debank you arbitrarily, even though it's "blockchain," because it's custodial.

- The permissionless alternative: Self-custodial infrastructure where you can prove AML compliance from your couch through client-side zero-knowledge proofs, without revealing where that couch actually is.

To build the second future, we need to take a hard turn towards zero-knowledge technology.

How zero-knowledge technology solves the trilemma

Zero-knowledge proofs solve all three issues of blockchain for real-world assets.

ZK gives us performance

In 2025, ZK is proven technology. According to L2Beat data, Ethereum rollups are processing 40,000 TPS. We're proving Ethereum state in real time. StarkEx and dYdX demonstrated the potential of ZK for scalability years ago.

ZK achieves high performance because you don't store everything onchain. Think of it like an iceberg: on Ethereum, you store the whole iceberg. With ZK, you only store the tip, and that secures the rest.

ZK gives us privacy

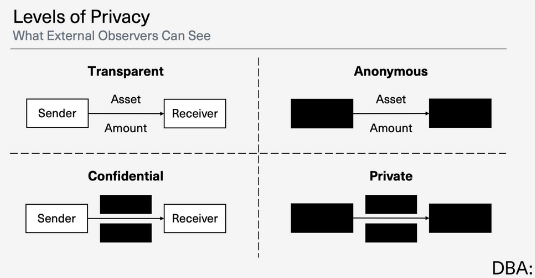

Zero-knowledge proofs enable both confidential and anonymous transactions, with flexibility in how much privacy you need.

Zcash demonstrates this well. The protocol uses notes and nullifiers to make it computationally infeasible to trace where money came from or where it's going. You can "quantum tunnel" through transactions without leaving a trail.

ZK enables selective disclosure for compliance

This is the critical piece: ZK can prove compliance without revealing underlying data.

You can generate proofs of:

- Passport validity

- Country of residence

- Available funds

- Non-inclusion on financial sanctions lists

- Age

Here's a concrete example: French identity cards and passports are cryptographically signed by the government. If you trust that public key, you can derive any verifiable information about a French citizen without revealing their identity.

This is selective disclosure. You prove the fact without revealing the data.

And it's working in production. If you participated in the Aztec token sale, you used zkPassport to prove you weren't a UK citizen. The process used secure enclaves in your iPhone with live FaceTime verification to prove you're a real human.

Putting the pieces together

With zero-knowledge technology, we have everything we need. ZK gives us privacy, performance, and compliance through selective disclosure.

The question is implementation.

At Hyli, we're building infrastructure that combines:

- Native ZK verification for privacy

- High-throughput consensus for performance

- Tools for permissionless KYC for compliance

We've been moving quickly. Since February, we've shipped:

- Client-side proving experiments with the Cairo team at Zama

- A Zcash-style token implementation (partly Noir, partly Rust)

- A RISC-V private orderbook based on the architecture of Lighter

- Multiple other projects as we prepare for mainnet launch early next year!

Why this matters

Our thesis is simple: finance will move onchain because blockchain is more efficient.

When that happens, you'll want to do AML compliance in a privacy-preserving, permissionless way.

That's why you need zero-knowledge KYC.

And we're just getting started. There's still $120 trillion to move onchain!