Selective disclosure: making blockchain work for institutional finance

Selective disclosure solves blockchain's privacy problem for institutions: prove compliance without exposing sensitive data.

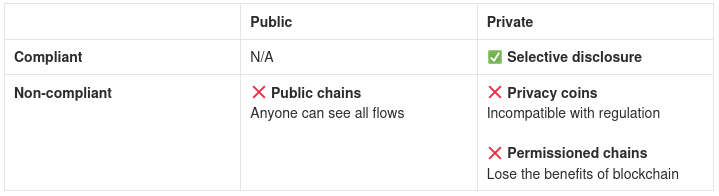

Blockchain promised to rewire finance. A decade later, most of that promise remains unfulfilled for one simple reason: institutions can't put sensitive data on a system where anyone can see it.

On public blockchains, every transaction, every balance, every counterparty relationship is public. This is a dealbreaker for most corporate and institutional finance.

There are some alternatives: privacy coins hide everything… including the information regulators need for audit trails. Permissioned chains restrict access, losing the composability that made blockchain valuable in the first place.

How do you keep transactions private and compliant at the same time? Through selective disclosure.

What is selective disclosure?

Selective disclosure is the ability to prove specific facts about data without needing to reveal all the underlying data itself.

For example, you can prove information like “the sender is not on any sanctions list” without revealing the data under it (in this case, the sender’s identity). The cryptographic proof is public and verifiable: the information used to create it remains private.

With selective disclosure, you control what you share, when, and with whom. a16z calls this "secrets-as-a-service" in their 2026 predictions.

How selective disclosure works

Selective disclosure relies on zero-knowledge proofs, a cryptographic technique that lets you prove a statement is true without revealing the information behind it.

The counterparty receives a mathematical guarantee of the transaction’s validity, not a data dump. The proof is verifiable by anyone, while the sensitive inputs stay hidden.

These proofs can also be combined. A single transaction can prove multiple things at once, for example: "sender passed KYC" + "recipient is not sanctioned" + "amount is under reporting threshold" + "both parties are in approved jurisdictions." Each proof is generated separately, then bundled together: the result is a compliance check that's both comprehensive and private, without the waste of reconciling siloed data.

| Stakeholder | What they see |

|---|---|

| Transaction parties | Full transaction details |

| Stablecoin issuer | Full visibility into their application |

| MiCA regulators | Selective disclosure on request for AML/CTF |

| General public | Proof that a transaction occurred, no details |

Example: a private stablecoin for a neobank

Imagine a neobank offering EUR stablecoins to its business client. They choose Hyli for its confidential transactions with on-demand regulatory access, enabled by selective disclosure.

The bank issues a MiCA-compliant EUR stablecoin on Hyli. Users complete standard KYB onboarding: their identity is verified once and stored off-chain. Onchain, they only have a cryptographic credential proving “this wallet belongs to a KYC-verified EuroWallet customer”.

Company A sends €5,000 to Company B to settle an invoice.

Onchain, a transaction is recorded: "Wallet A sent tokens to Wallet B on the EuroWallet EUR contract.” The identity of the companies and the amount are not made public. A set of cryptographic proofs attests that both wallets hold valid KYB credentials, neither party is on sanction lists, and the transaction follows the neobank’s compliance rules.

| Stakeholder | What they see |

|---|---|

| **Company A | |

| Company B** | Full details: €5,000, counterparty name, timestamp, memo |

| Public blockchain explorer | A transaction occurred on the bank’s EUR contract |

| Bank’s compliance team | Transaction metadata + proof that both users passed KYC (no raw identity data unless they query their own database) |

| Competitor company | A transaction occurred on the bank’s EUR contract: no amounts, no identities. |

| MiCA regulator (on lawful request) | Both companies’ verified identity, €5,000, date. The bank can selectively decrypt this specific transaction without exposing their entire ledger. |

The cryptographic model behind selective disclosure allows the transaction to prove many pieces of information without ever revealing them to malicious or external parties:

- KYC/KYB status: the proof confirms that both parties completed identity verifications, but doesn’t show their details

- Neither wallet appears on OFAC, EU, or UN sanctions lists: the bank has encoded compliance rules into its transfers

- Reporting if the transaction is above a given threshold, or proof of the transaction being below the limit (without necessarily making that limit public)

This benefits everyone involved. The companies have made a private payment that is protected from the gaze of competitors, suppliers, and random observers, while keeping the user experience of their normal payment app. The bank has full visibility into their own stablecoin and can respond to regulator requests without exposing their entire transaction history. Regulators have on-demand access to any specific transaction and get mathematical proof that compliance rules have been followed.

The bank can offer a EUR stablecoin that European businesses will use: it respects commercial confidentiality while meeting regulatory requirements.

When is selective disclosure useful?

Recognizing a sensitive flow

A sensitive flow is a financial transaction where visibility creates risk.

This can include:

- Competitive intelligence leakage, such as competitors seeing your trading strategies

- Frontrunning risks when others trade ahead of known intentions

- Personal information breaches, such as salary amounts

- Market manipulation exposure when large positions are visible

Traditional finance keeps this information private by default, but suffers from many issues such as the cost of reconciling siloed data. On the other hand, most blockchains force radical transparency, creating these dire risks.

How selective disclosure compares to alternatives

Privacy coins are not regulation-friendly

Privacy coins, like Monero and Zcash, offer very strong transaction confidentiality.

The problem is that they have no mechanism for selective access. The source of funds remains secret and suspicious activity cannot be monitored efficiently. This creates a compliance and regulatory risk.

MiCA doesn’t explicitly ban privacy coins, but compliance obligations on custodians, payment processors, and banks have raised questions on how long exchanges can keep supporting them. Binance, Kraken, and other major exchanges have delisted these coins across European markets in the past years.

Privacy coins solve the wrong problem: institutions don’t need to hide from everyone. Selective disclosure offers a balance between hiding from competitors and the public while remaining visible to regulators whenever required.

Permissioned chains lose the benefit of blockchain

Permissioned chains take a different approach. Instead of hiding transactions, they restrict who can participate: only approved institutions can join the network.

This solves the privacy problem, as the public no longer accesses the sensitive information in the transactions. But it also eliminates the benefits that made blockchains worth using in the first place.

Permissioned chains cannot communicate seamlessly: assets remain stuck in a network, which fragments capital across dozens of incompatible systems. A blockchain with just a few participants requires bilateral or multi-party agreements, removing the benefits from the thousands of counterparties on public rails. The promise of decentralization disappears as participants depend on the consortium operator for all actions.

The irony is that permissioned chains recreate the problem blockchain was supposed to solve: siloed systems that don’t talk to each other.

Selective disclosure is private and compliant

Selective disclosure offers a different solution. Transactions are confidential by default, but issuers and regulators can access specific data when they have the proper authority to do so.

Institutions can then respond to lawful requests, audits, and investigations without exposing everyone’s transaction history. Regulators can verify cryptographic guarantees, not just trust claims.

Selective disclosure is private enough for commercial confidentiality, transparent enough for compliance, and open enough to benefit from the liquidity and composability offered by public blockchains.

Selective disclosure is the missing piece that makes blockchain viable for real financial infrastructure.

Selective disclosure offers confidentiality as the default, compliance on demand, and cryptographic guarantees for both. The technology exists today. The regulatory frameworks are catching up. The infrastructure will be ready when they do.

Ready to see selective disclosure in action? Let's talk!